New York’s Older Homeowners Still Vulnerable to Predatory Lending

IT was one of the worst examples of predatory lending that the Brooklyn Neighborhood Improvement Association had ever seen. “Here’s an elderly couple – at that time they were in their 70s,” said Maurice Cole, the BNIA’s Senior Foreclosure Counselor, as he leaned forward in his desk chair. “They filled out an application – and I saw it – stating that this woman was working, making money,” Mr. Cole pounded his desk with each word. “They just railroaded those people into a mortgage.”

Across the desk, Andrea Phillips-Merriman, the BNIA’s Community Development Specialist, nodded as Mr. Cole spoke. She interjected calmly as Mr. Cole became too flustered to continue, “They were in their 70s and 80s, and [their lender] gave them a mortgage knowing full well that they had no income.” Mr. Cole murmured agreement as Ms. Phillips-Merriman continued, “So now they were saddled with a mortgage that they couldn’t pay.”

“Needless to say,” said Mr. Cole, “these people’s property was in foreclosure.”

What made the case of the elderly couple’s lending agreement a “classic case of predatory lending,” according to their counselors at the BNIA, was the borrowers’ ignorance of the lending process and their inability to meet the terms of the mortgage they were issued.

According to the Department of Housing and Urban Development’s definition of predatory lending, a predatory loan takes “unfair advantage of a borrower’s lack of understanding about loan terms,” and these loans often involve terms that “are abusive or make the borrower more vulnerable to abusive practices.” Official agencies and housing advocacy groups assert that elderly borrowers are particularly

vulnerable to predatory lending practices.

“Financial literacy is definitely an issue,” said Thomasina White-Henderson, Director of Compliance for the Parodneck Foundation, a non-profit housing development organization based in New York City. She agreed with the BNIA staff’s assessment that older borrowers tend to be more vulnerable to predatory lending because of their unfamiliarity with their options.

She added that elderly borrowers are at an additional disadvantage as borrowers because of their tendency to have limited income and limited access to credit. “The majority of seniors that come to us don’t qualify for a conventional loan,” she said. If an elderly homeowner needed a loan for home repairs, for example, his or her options would be limited.

How does a borrower with a fixed income and limited access to credit come to be saddled with a mortgage they can’t pay for? Mr. Cole explained that he often finds, upon asking clients how they fell behind on their payments, that many of his clients weren’t actively seeking mortgages but were approached by lenders who told them that they could be issued mortgages. He explained that these kinds of borrowers often would be exposed to these kinds of lending agreements through advertizing.

“Their first contact would be with a real estate broker, who, in a sense, lures them into the process,” said Ms. Phillips-Merriman. Brokers, she continued, often would suggest to clients who already owned a home that the borrower could buy a new property and rent it to Section 8 tenants. “These people believed that the process of owning is very simple because the rental would be the backup for their inadequate income,” she said.

But because of a multitude of variables, including non-fixed interest rates on their mortgages and unreliable tenants, borrowers discovered just how complicated their situations were. “We’re now experiencing the fallout from these practices,” said Ms. Phillips-Merriman.

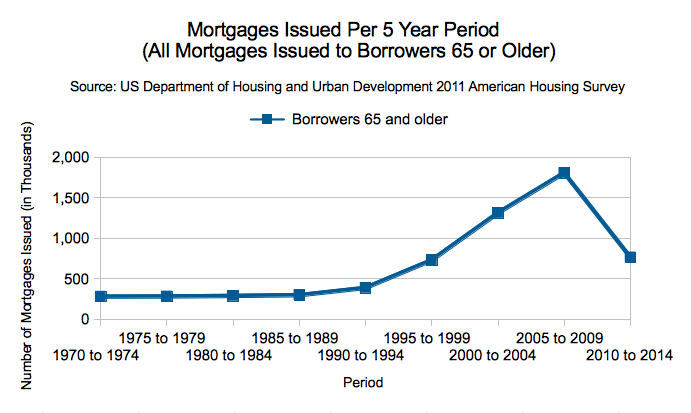

According to the 2011 American Housing Survey, which is performed by the Department of Housing and Urban Development and based on information collected by the Census Bureau, mortgages issued to borrowers over the age of 65 rose at a gradual pace between the 1970s and the mid 1990s. The rate of issuance then nearly doubled between 1999 and 2004, and it continued to surge until around 2009, after which point it fell dramatically.

The BNIA has observed a decrease in their rate of observation of new predatory lending agreements. But with the decline of such agreements, they observed the emergence of new predatory practices to which elderly borrowers are especially vulnerable.

Mortgage modification counseling services, which involve an expert working with a borrower to try and secure a loan modification with their lender, rose substantially in prominence as the rash of subprime loans issued to at-risk borrowers began to become distressed. Borrowers whose adjustable interest rates increased started to become unable to make their payments, and large numbers of borrowers began facing foreclosure.

Ms. Phillips-Merriman explained that when a foreclosure notice is issued by a bank, it becomes a matter of public record. For-profit mortgage modification counseling services began to emerge, and she explained that they would come into contact with distressed borrowers upon observation of their public foreclosure notices. They would then charge borrowers large fees, in some cases several thousand dollars, to attempt to secure a loan modification with their lender. Some service providers could charge fees even if they were unsuccessful in securing a modification of their clients’ loan agreements.

“They have somebody [at the court] every day,” Ms. Phillips-Merriman said, of the for-profit mortgage modification services, watching for new notices of foreclosure. Records of homeowners who have not paid their taxes also become public, she said, and agents of for-profit counseling services seek out this information. “That is their business – to find homeowners who are in distress and to proposition them to buy their house or to do a service for them that will cost the homeowner money.”

For-profit loan modification services are not illegal, but they have been the subject of criticism by non-profits like the BNIA, and they have been scrutinized by lawmakers. The Federal Trade Commission, as well as state law enforcement agencies, have pursued legal action against some for-profit modification services as well.

Ms. Phillips-Merriman unequivocally characterizes all for-profit mortgage modification counseling services as predatory. “They are charging people for a service that is free,” she said. Non-profit counseling services like BNIA work to help borrowers secure loan modifications with their lenders at no cost to the borrower. They also combine financial literacy training and other counseling services to prepare their clients to deal with lenders, both before and after attempting to secure a loan.

These services also advise their clients of the options available to them if they face risk of foreclosure. Ms. Phillips-Merriman explained that the federal government’s reverse mortgage program was an example of a way for homeowners 62 and older to access the equity in their homes. They could receive monthly payments, a lump sum, or a bank credit on the basis of the equity available in their homes from the federal government. This money could be used for any purpose, including housing expenses, medical costs or payment of other outstanding debts, and the loan does not have to be paid back until after the homeowner dies or vacates their home. “It’s an opportunity for senior borrowers to remain independent,” she said.

The heirs to the homeowner’s property can then sell the property and use the proceeds of the sale to repay the debt to the government, or they can refinance the mortgage with a private lender to assume ownership of the property if they so desire.

One of the eligibility requirements that reverse mortgage applicants must meet is certification by a non-profit counselor that they thoroughly understand the terms of their reverse mortgage. Ms. Phillips-Merriman explained that a borrower cannot secure a reverse mortgage without that certification, which is designed to prevent the borrower from entering into an agreement they don’t understand.

The process is not without risks – elderly borrowers are still at risk of becoming involved in a loan that they can’t handle, because of coercion from family members or for other reasons, but the government mandates that every borrower who seeks a reverse mortgage participate in a counseling session that clearly demonstrates to them the steps involved in securing the reverse mortgage and the terms of the agreement.

The best method at the disposal of elderly homeowners and potential borrowers to avoid involvement in an unsustainable mortgage is self-education. This is the point most emphasized by government consumer protection bodies and non-profit advocates: elderly borrowers may be vulnerable, but they are not powerless.

Related Stories:

Will Older New Yorkers be Ready for the Next Sandy?

Low Pay and High Turnover a Barrier to Quality Home Care

Educators Fight Stigma, Provide Support as HIV Increasingly Affects Older Adults